UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statementproxy statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,proxy statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

DATED JULY 7, 2017

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

March 15, 2017

Dear Superior Stockholder:

You are cordially invited to attend the Annuala Special Meeting of Stockholders (the “Special Meeting”) of Superior Industries International, Inc. (the “Annual Meeting”(“we,” “us” or the “Company”), which will be held at the Westin Detroit Metropolitan Airport Hotel (2501 Worldgateway Place, Detroit, Michigan 48242) on April 25,, 2017, at 10:00 a.m.: Eastern Daylight Time.

During 2016, Superior Industries International, Inc.On March 22, 2017, we entered into an Investment Agreement with TPG Growth III Sidewall, L.P. (“TPG” or the “Investor”) pursuant to which we agreed to issue a number of shares of Series A Perpetual Convertible Preferred Stock, par value $0.01 per share (the “Company”“Series A Preferred Stock”), and Series B Perpetual Convertible Preferred Stock, par value $0.01 per share (the “Series B Preferred Stock” and, together with the Series A Preferred Stock, the “Preferred Stock”), to the Investor for an aggregate purchase price of $150 million (the “Investment”). The Series A Preferred Stock is convertible into shares of our common stock, par value $0.01 per share, at the option of the holder or, “Superior”upon the occurrence of certain events, at our option. The Series B Preferred Stock is convertible into Series A Preferred Stock only upon receipt of approval by Superior’s stockholders as described herein. At the closing of the Investment on May 22, 2017, we issued 140,202 shares of Series A Preferred Stock, which was equal to 19.99% of the shares of common stock outstanding on such date on an as converted basis, and 9,798 shares of Series B Preferred Stock to the Investor.

At the Special Meeting, holders of shares of our common stock and Series A Preferred Stock (other than the Investor) will be asked to consider and vote on a proposal to approve the following rights in connection with the Investment: (i) the conversion of all outstanding shares of Series B Preferred Stock into shares of Series A Preferred Stock and the subsequent issuance of shares of common stock upon election by the holder to convert the Series A Preferred Stock, and the right to receive additional shares of Series A Preferred Stock relating to non-cash dividends paid in the form of an increase in the Stated Value (as defined below) of the Series A Preferred Stock (collectively, the “Conversion Right”) continuedand (ii) the Investor’s preemptive rights to drive improvementparticipate in its financial and operational performance, return capital to our stockholders and engage with our stockholders on important topics such as executive compensation.

Below are a fewfuture Company issuances of common stock or securities convertible into or exercisable for common stock (the “Preemptive Right”), each of which right requires the approval of the Company’s recent key initiatives:

Continued Focus on Value Creation. Overstockholders in accordance with the past few years, the Company assembled a results-driven experienced management team that has identifiedrules and executed upon significant opportunities for operational improvements. Additionally, the Company has enhanced the value it provides to its customers by providing an expanded product offering that includes lighter weight wheels, larger diameter wheels and more sophisticated finishes. This ability to provide value meeting a wider spectrumregulations of our customer’s needs, by utilizing proprietary technologies, allows us to differentiate ourselves from the market. In 2016, we also made progress towards and completed various manufacturing, operational and organizational initiatives that continue to enhance our competitive position including:

Further highlights from our 2016 performance can also be found in the “2016 Performance & Business Highlights” and “Compensation Discussion and Analysis” sections of the attached Proxy Statement.

Strategic PlanThe New York Stock Exchange (the “NYSE”). We reaffirmed our commitmentrefer to the strategic plan we introduced in 2015, which is focused on improving our global competitiveness, building on our culture of product innovationproposals to approve the Conversion Right and technology, evaluating opportunities for disciplined growth and value creation, maintaining a balanced approach to capital allocation and increasing our visibility with the financial community. We are seeking to achieve these priorities by, among other actions:Preemptive Right collectively as the “Equity Rights Proposal.”

Our management works closely with our Board of Directors (the “Board”) to monitorunanimously approved the progress being made on our strategic plan. The Board reviews Superior’s strategic plan at least annuallyEquity Rights Proposal and more frequently as significant opportunities or events arise.

Continued to Return Capital to Stockholders. We continue to evaluate different strategies for maximizing our stockholders’ return on investment. We are proud to have returned over $39.1 million torecommends that our stockholders in 2016 through share repurchases and dividends. Through March 1, 2017, we have $35.0 million outstanding onvote “FOR” the Equity Rights Proposal.

If our current share repurchase authorization.

Maintained Strong Financial Metrics. In 2016, we achieved solid positive results in a number of our financial metrics, including: unit sales growth, value-added sales(1), net sales, net income, EBITDA(2) and diluted EPS, as well asstockholders do not approve the lowering of our effective tax rate. WithEquity Rights Proposal presented at the completion of our new Mexican facility in 2015, our capital expenditures have been significantly reducedSpecial Meeting, the Series B Preferred Stock will not be converted into Series A Preferred Stock, and the Company ended 2016 with a sound cash position and balance sheet, all while continuingdividend rate applicable to return capitalthe Series B Preferred Stock will increase from 9% per annum to our stockholders. This positions the Company to be well positioned to continue investing in our business as well as acting upon opportunities that are consistent with our strategic plan.

Proxy Access Proposal Implemented. The Company’s proxy access proposal that was submitted to our stockholders was overwhelmingly supported by our stockholders at our 2016 annual meeting. Following that meeting, our directors conducted further dialogue with some of our stockholders to receive further input11% per annum beginning on September 19, 2017. Dividends on the proposal. Following that outreach,Preferred Stock are payable, at the Board adopted a proxy access proposalCompany’s election, in October 2016.

Your Votecash or in the form of an increase in the stated value (initially, $1,000 per share, the “Stated Value”) of such Preferred Stock. Until stockholder approval is Important. We, andobtained, any non-cash dividends on either the restSeries A Preferred Stock or the Series B Preferred Stock must be paid in the form of an increase in the Stated Value of the Board, invite you to attendSeries B Preferred Stock and shall not result in an increase in the Annual Meeting. If you are not able to attendStated Value of the Series A Preferred Stock.

Please carefully read the accompanying proxy statement in person, we encourage you to vote by proxy. The Proxy Statement contains detailedits entirety for information about the matters on whichto be voted upon. You may also obtain more information about the Company from documents we are asking you to vote.have filed with the Securities and Exchange Commission; see “Where You Can Find More Information” in the accompanying

i

proxy statement. Your vote is important. Whether or not you plan to attend the Annual Meeting, your vote is important, andmeeting in person, we encourageurge you to vote promptly. You can votesubmit your shares over the telephone,proxy as soon as possible via the Internet, by telephone or by completing, dating, signing and returning a proxy card, as described in the Proxy Statement.mail.

Thank you for your ongoing support of, and continued interest in, Superior.

|

| |

Donald J. Stebbins | ||

| President and Chief Executive Officer | Chairman of the Board |

A Note from Donald J. Stebbins

In this Proxy Statement, you will note that Ms. Dano has chosen not to run for reelection as a member of our Board. She made this decision after giving consideration to her other commitments as well as reflecting on the fact that, in large part through her leadership efforts, our Board is now in very capable hands, making it an appropriate time for her to transition her leadership role to others.

While I share her conviction that our Board is in very capable hands, I cannot emphasize how much Ms. Dano’s leadership will be missed. Since her arrival on the Board in 2007, she has been a strong advocate for moving Superior forward. During her tenure, Superior expanded its Mexican operations, dealt with numerous board member and executive transitions, moved its headquarters to its present location in Michigan and oversaw the expansion of Superior’s customer base and product offerings. All of these efforts combined to make Superior one of the best suppliers of automotive and light truck wheels in the world.

I trust you share the sentiment of the other Board members and all employees of Superior in wishing Ms. Dano continuing success in both her professional and personal pursuits.

| ||

| ||

| ||

This Proxy Statementproxy statement is dated March 15,, 2017 and is first being made available to stockholders via the Internet on or about March 16,, 2017.

ii

DATED JULY 7, 2017

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

NOTICE OF 2017 ANNUALSPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON , 2017

Time and Date: | ||

Place: |

| |

Record Date: |

Each holder of Superior common stock and Series A Preferred Stock as of the Record Date (other than the Investor) will be entitled to one vote on each matter for each share of common stock held, or into which such holder’s Series A Preferred Stock is convertible, on the Record Date. | |

Items to Be Voted On: | 1. To

2. To consider and vote on a proposal to approve

| |

How to Vote: | YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE | |

| BY ORDER OF THE BOARD OF DIRECTORS, |

/s/ |

Nadeem Moiz |

Secretary |

Southfield, Michigan

March 15, , 2017

Notice of Electronic Availability of Proxy Statement and Annual Report

As permitted by rules adopted by the United States Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and our Annual Report available to stockholders electronically via the Internet. On or about March 16, 2017, we will mail to most of our stockholders a notice (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and to vote via the Internet or by telephone.

The Notice also contains instructions on how to request a printed copy of the proxy materials. In addition, you may elect to receive future proxy materials in printed form by mail or electronically bye-mail by following the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials viae-mail, unless you elect otherwise.

| 1 | ||||

| ||||

| 14 | ||||

| 19 | |||

|

| ||||

| ||||

| ||||

PROXY SUMMARYINFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Why did you send me this proxy statement?

We sent you this proxy statement and the proxy card because the Board of Directors (the “Board”) of Superior Industries International, Inc. (the “Company”) is soliciting your proxy to vote at the special meeting of stockholders (the “Special Meeting”) to be held on , 2017, at : Eastern Daylight Time, at , and at any postponements or adjournments of the Special Meeting. This summary highlights selectedproxy statement summarizes information contained elsewherethat is intended to assist you in making an informed vote on the proposals described in this Proxy Statement. This summary does not contain allproxy statement.

What is the purpose of the information that you shouldSpecial Meeting?

On March 22, 2017, we entered into an Investment Agreement with TPG Growth III Sidewall, L.P. (“TPG” or the “Investor”) pursuant to which we agreed to issue a number of shares of Series A Perpetual Convertible Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”), and Series B Perpetual Convertible Preferred Stock, par value $0.01 per share (the “Series B Preferred Stock” and, together with the Series A Preferred Stock, the “Preferred Stock”), to the Investor for an aggregate purchase price of $150 million (the “Investment”). The Series A Preferred Stock is convertible into shares of our common stock, par value $0.01 per share, at the option of the holder or, upon the occurrence of certain events, at our option. The Series B Preferred Stock is convertible into Series A Preferred Stock only upon receipt of approval by Superior’s stockholders, as described herein. At the closing of the Investment on May 22, 2017, we issued 140,202 shares of Series A Preferred Stock, which was equal to 19.99% of the shares of common stock outstanding on such date, and 9,798 shares of Series B Preferred Stock to the Investor.

As described in more detail below, in accordance with the terms of the Investment Documents (as defined below) and applicable rules, regulations and guidance of the New York Stock Exchange (“NYSE”), the Company is calling the Special Meeting to consider and you should readvote upon a proposal to approve certain of the entire Proxy Statement carefully before voting. For more complete information regarding our 2016 performance, please review our 2016 Annual Report on Form10-K for the year ended December 25, 2016 filedInvestor’s rights associated with the SECPreferred Stock. The Special Meeting described in this proxy statement is scheduled to be held on March 3, 2017.

The 2016 annual report to stockholders, including financial statements, is being made available to stockholders together with, 2017, and we are providing these proxy materials on or about March 16, 2017.to you in connection with the Special Meeting.

2017 ANNUAL MEETING OF STOCKHOLDERS – ANNUAL MEETING INFORMATION

| ||

|

| |

| ||

| ||

For more information regardingAt the AnnualSpecial Meeting, and voting, please see our “Q&A” Section, found at page 63.

2017 ANNUAL MEETING OF STOCKHOLDERS – AGENDA AND VOTING RECOMMENDATIONS

Proposals: | Board Voting Recommendation: | Page Reference for More Detail: | ||||

1. | Election of Directors | “FOR” all nominees | 6 | |||

2. | To approve, in anon-binding advisory vote, executive compensation of the Company’s named executive officers; | “FOR” | 27 | |||

3. | To select, in anon-binding advisory vote, the frequency of thenon-binding advisory vote on executive compensation of the Company’s named executive officers; | “1 YEAR” | 29 | |||

4. | Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2017 | “FOR” | 30 | |||

YOUR VOTE IS IMPORTANT.Whether or not you plan to attend the Annual Meeting, your vote is important, and we encourage you to vote promptly. You can vote yourholders of shares over the telephone, via the Internet or by completing, dating, signing and returning a proxy card, as described in the Proxy Statement. Your prompt cooperation is greatly appreciated.

2016 PERFORMANCE & BUSINESS HIGHLIGHTS

Since 2014, we have focused our strategic priorities on improving our financial and operating performance and increasing value for our stockholders. Even though the full impact of our operating initiatives has yetcommon stock and Series A Preferred Stock (other than the Investor) will be asked to be fully reflected in our financial performance, as discussed below, we continued seeing positive results in 2016.

Recent Business Highlights/Company Performanceconsider and vote upon the following proposals:

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

What are the Board’s voting recommendations?

The Board unanimously approved the Equity Rights Proposal and the Adjournment Proposal, and unanimously recommends that the Company’s stockholders vote “FOR” each of these proposals.

Why did the Company Approve the Investment?

The Board approved the Investment to finance a portion of the purchase price for the Company’s acquisition of 92.3% of the outstanding common stock of Uniwheels AG by means of a tender offer, which closed on May 30,

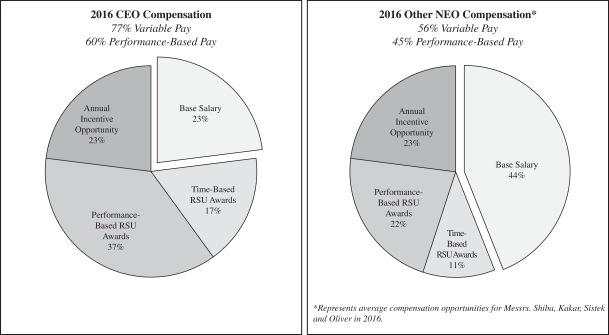

EXECUTIVE COMPENSATION HIGHLIGHTS

Highlights of our 2016 executive compensation program and recent changes are summarized as follows.

2016 Executive Compensation Highlights and Recent Changes

Why is the Company seeking approval of the Equity Rights Proposal?

We are required to seek approval of the Equity Rights Proposal pursuant to the terms of the Investment Agreement and the related agreements and other documents entered into by the Company and the Investor in connection with the Investment Agreement, including the Investor Rights Agreement, dated as calculated over a three-year period:

As discussed inof May 22, 2017 (the “Investor Rights Agreement”), by and between the “2016 Executive Compensation Components – Long-Term Equity Incentive Compensation” section of this Proxy Statement, these performance measures were developed after a rigorousbottom-up financial analysis of our business.

2016SAY-ON-PAY VOTE AND STOCKHOLDER ENGAGEMENT

Leading upCompany and the Investor. The Investment Agreement and the Investor Rights Agreement are referred to our 2016 annual meeting, members of our senior executive team and members of our Compensation and Benefits Committee engaged with many of our largest stockholders and heard their input regarding our executive compensation programs. As a result of these discussions and before last year’s vote was tallied, we:

At our 2016 annual meeting, our stockholders did provide majority support for Superior’s NEO compensation throughherein, collectively, as theSay-on-Pay Vote (approximately 67% support was received). However, since we received less than 70% support, we continued to engage in substantial outreach efforts with our major stockholders and their proxy advisors to gather feedback regarding our executive compensation programs.

Following the 2016 annual meeting, directors from our Compensation and Benefits Committee held additional meetings with significant stockholders, and we also engaged and met with one proxy advisory firm regarding our executive compensation programs. Senior management also continually received input in the normal course of meetings with our stockholders. “Investment Documents.”

In addition, the Company’s common stock is listed on the NYSE and, as a result, the Company is subject to certain NYSE listing rules and regulations. Rule 312.03(c) of the Compensation and Benefits Committee’s reviewNYSE Listed Company Manual (“NYSE Rule 312.03(c)”) requires stockholder approval prior to the issuance of our programscommon stock, or securities convertible into or exercisable for common stock, in lightany transaction or series of transactions if (i) the common stock to be issued has, or will have upon issuance, voting power equal to or in excess of 20% of the 2016Say-on-Pay results, we tookvoting power outstanding before the following actions:

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board is committed to having a sound governance structure that promotes the best interestsissuance of our stockholders. The following table highlights certainsuch stock or of our governance practices:

Name | Age | Director Since | Principal Occupation | Independent | Board Committees | |||||||||

Michael R. Bruynesteyn | 53 | 2015 | Treasurer & Vice President, Strategic Finance of Turner Construction Company | X | • Audit Committee • Nominating & Corporate Governance Committee | |||||||||

Jack H. Hockema | 70 | 2014 | Chairman & CEO of Kaiser Aluminum Corporation | X | • Audit Committee • Nominating & Corporate Governance Committee (Chair) | |||||||||

Paul J. Humphries | 62 | 2014 | President of High Reliability Solution (a business group of Flextronics International Ltd.) | X | • Audit Committee • Compensation & Benefits Committee | |||||||||

James S. McElya | 69 | 2013 | Chairman of the Board of Directors, Affinia Group Intermediate Holdings Inc. | X | • Compensation & Benefits Committee (Chair) • Nominating & Corporate Governance Committee | |||||||||

Timothy C. McQuay | 65 | 2011 | Retired Managing Director, Investment Banking with Noble Financial Markets | X | • Audit Committee (Chair) • Compensation & Benefits Committee | |||||||||

Ellen B. Richstone | 65 | 2016 | Retired Chief Financial Officer, Rohr Aerospace | X | • Audit Committee • Nominating & Corporate Governance Committee | |||||||||

Donald J. Stebbins | 59 | 2014 | President and CEO of Superior Industries International, Inc. | |||||||||||

Francisco S. Uranga | 53 | 2007 | Corporate Vice President & Chief Business Operations Officer for Latin America, Foxconn | X | • Compensation & Benefits Committee • Nominating & Corporate Governance Committee | |||||||||

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Margaret S. Dano, who has served on our Board since 2007 and as our Chairperson since 2014, will retire from the Board upon the expiration of her term at the Annual Meeting. The Board would like to thank Ms. Dano for her years of dedicated service to the Company. Although we presently have nine directors, as a result of Ms. Dano’s retirement from the Board, the Board has resolved to reduce the number of directors from nine to eight effective upon Ms. Dano’s retirement fromshares of common stock outstanding before the Board immediately followingissuance of the Annual Meeting.

Uponcommon stock or of securities convertible into or exercisable for common stock (collectively, the recommendation“Conversion Cap”). Because of this restriction, in exchange for the Investor’s $150 million investment in the Company, the Investor received 140,202 shares of Series A Preferred Stock, which was convertible into a number of shares of common stock representing approximately 19.99% of our Nominatingoutstanding common stock prior to such issuance and, Corporate Governance Committee,in lieu of additional shares of Series A Preferred Stock, the BoardInvestor received 9,798 shares of Series B Preferred Stock. Pursuant to the terms of the Company’s Certificate of Designations relating to the Preferred Stock (the “Certificate of Designations”), the Series B Preferred Stock will convert into our Series A Preferred Stock (and, consequently, become convertible into our common stock) following stockholder approval.

The NYSE has nominatedcertain additional rules, including Rule 312.03(b) of the eight individuals listed belowNYSE Listed Company Manual (“NYSE Rule 312.03(b)”), which requires stockholder approval prior to stand for electionissuances of securities to, among others, directors and substantial stockholders of the Company, that could be implicated in the future if the Investor exercises the Preemptive Right. In order to eliminate any requirement that the future exercise of the Preemptive Right would require stockholder approval, we are seeking such approval now as part of the Equity Rights Proposal. For a more detailed description of the Preemptive Right, see the description under “Description of the Investment Documents—Investor Rights Agreement—Preemptive Rights” below.

What will happen if the Company’s stockholders do not approve the Equity Rights Proposal?

If the Company’s stockholders do not approve the Equity Rights Proposal, then the Series B Preferred Stock will not convert into Series A Preferred Stock and will remain outstanding. Furthermore, if stockholder approval is not obtained by September 19, 2017, the dividend rate applicable to the Series B Preferred Stock will increase from 9% per annum to 11% per annum unless and until stockholder approval is obtained. Dividends on the Preferred Stock are payable, at the Annual Meeting for aone-year term endingCompany’s election, in cash or in the form of an increase in the stated value (initially, $1,000 per share, the “Stated Value”) of such Preferred Stock. Until stockholder approval is obtained, any non-cash dividends on either the Series A Preferred Stock or Series B Preferred Stock must be paid in the form of an increase in the Stated Value of the Series B Preferred Stock and shall not result in an increase in the Stated Value of the Series A Preferred Stock.

What will happen if the Company’s stockholders approve the Equity Rights Proposal?

If the Company’s stockholders approve the Equity Rights Proposal, each share of Series B Preferred Stock will convert into one share of Series A Preferred Stock. Additionally, the Series A Preferred Stock will no longer

2

be subject to the Conversion Cap, and all shares of Series A Preferred Stock will be convertible into shares of common stock at the annual meetingoption of stockholdersthe Investor or, in 2018 or untilcertain circumstances, at the option of the Company.

Will the Conversion Right be dilutive to existing holders of the Company’s common stock?

The Conversion Right may be dilutive to existing stockholders. Approval of the Equity Rights Proposal will cause the conversion of Series B Preferred Stock into shares of Series A Preferred Stock and will remove the restriction imposed by the Conversion Cap, allowing holders of the Series A Preferred Stock to convert all of their successors, if any, are elected or appointed. All nominees have consentedshares of Series A Preferred Stock into common stock. Based on the capitalization of the Company as of the Record Date, the conversion of all of the outstanding shares of Series A Preferred Stock (including shares of Series A Preferred Stock issuable upon the conversion of the Series B Preferred Stock) would result in TPG owning approximately % of our outstanding common stock. At the same time, however, approval of the Equity Rights Proposal will eliminate the outstanding Series B Preferred Stock, which is senior to be named in this Proxy Statementthe common stock as to payment of dividends and to serve as directors, if elected. Indistribution of assets upon liquidation, dissolution or winding up of the event that any nomineeCompany.

Who is unable or declinesentitled to serve as a directorvote at the timeSpecial Meeting?

The record holders of the Annual Meeting, the proxies will be voted for the election of a substitute nominee(s) proposed by the Nominating and Corporate Governance Committeeshares of the Board. If any such substitute nominee(s)Company’s common stock and 140,202 shares of Series A Preferred Stock outstanding on the close of business on , 2017 are designated, we will file an amended proxy statement and proxy card that identifiesentitled to vote at the substitute nominee(s) and provide information required by the rulesSpecial Meeting, except as set forth below. The holders of the SEC.Company’s common stock are entitled to one vote for each share of common stock on each matter submitted to a vote at the Special Meeting, and holders of Series A Preferred Stock are entitled to one vote for each share of common stock into which the Series A Preferred Stock would be convertible as of the Record Date. As of the dateRecord Date, the 140,202 shares of this Proxy Statement,Series A Preferred Stock outstanding would be convertible into shares of common stock. TPG, as a holder of the BoardCompany’s Series A Preferred Stock, is not awareentitled to vote on the Equity Rights Proposal presented at the Special Meeting, but is permitted to vote on the Adjournment Proposal.

What is a broker non-vote?

The term broker non-vote refers to shares held by a brokerage firm or other nominee (for the benefit of its client) that anyare represented at the Special Meeting, but with respect to which such broker or nominee is unablenot instructed to vote on a particular proposal and does not have discretionary authority to vote on that proposal. Brokers and nominees do not have discretionary voting authority on certain non-routine matters, such as the Equity Rights Proposal and the Adjournment Proposal, and accordingly may not vote on such matters absent instructions from the beneficial holder. If you hold your shares in “street name” or will decline to serve asthrough a director.broker, it is important that you give your broker your voting instructions.

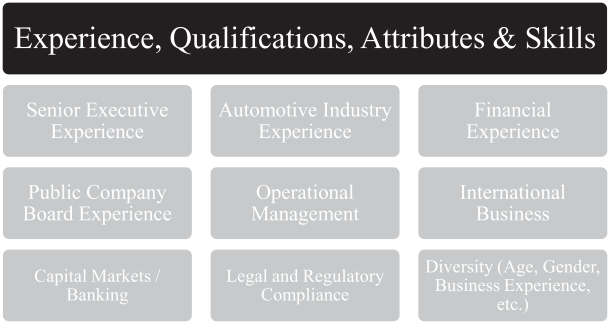

The Board, through the Nominating and Corporate Governance Committee, considers the following experience, qualifications, attributes and skills of both potential director nominees as well as existing members of the Board:

For more information regarding director nominations and qualifications, see the sections titled “Information about Director Nominees” (beginning on page 7) and “Director Selection” (beginning on page 17).

Information about Director Nominees

Set forth below is information about our nominees, including their names and ages, recent employment or principal occupation, their period of service as a Superior director, the names of other public companies for which they currently serve as a director or have served as a director within the last five years and a summary of their specific experience, qualifications, attributes or skills that led to the conclusion that they are qualified to serve as a director.

Each of the nominees for director has been nominated for election by the Board upon recommendation by the Nominating and Corporate Governance Committee and has consented to serve if elected. When a member of the Nominating and Corporate Governance Committee is under consideration for nomination, the nominee typically recuses himself or herself from the discussion and abstains from the voting on the recommendation.

MICHAEL R. BRUYNESTEYN

Treasurer and Vice President, Strategic Finance, Turner Construction Company

|

|

JACK A. HOCKEMA

Chief Executive Officer, Kaiser Aluminum Corporation

|

|

PAUL J. HUMPHRIES

President of High Reliability Solutions, a business group at Flextronics International Ltd.

|

|

JAMES S. MCELYA

Chairman of the Board of Directors, Affinia Group Intermediate Holdings Inc.

|

|

TIMOTHY C. MCQUAY

Retired Managing Director, Investment Banking, Noble Financial Capital Markets

|

|

ELLEN B. RICHSTONE

Retired Chief Financial Officer, Rohr Aerospace

|

|

DONALD J. STEBBINS

Superior Industries International, Inc. President and Chief Executive Officer

|

|

FRANCISCO S. URANGA

Corporate Vice President and Chief Business Operations Officer for Latin America, Foxconn

|

|

Each director nominee must receive the affirmative vote of a plurality of the votes cast to be elected, meaning thatconducted at the eight persons receiving the largest number of “yes” votes willSpecial Meeting, a quorum must be elected as directors. You may vote in favor of any or all of the nominees or you may withhold your vote as to any or all of the nominees. The nominees receiving the highest number of affirmative votespresent. A majority of the shares entitled to vote, represented in person or by proxy, shall constitute a quorum. Accordingly, shares representing votes must be present in person or by proxy at the meetingSpecial Meeting to constitute a quorum. Abstentions are counted as present for the purpose of determining a quorum; broker non-votes are not counted for the purpose of determining the presence of a quorum at the Special Meeting as the proposals to be considered would not be evaluated as routine by the NYSE.

If a quorum is not present, the Special Meeting will be elected as directors. Proxies may not be voted for more than the eight directors and stockholders may not cumulate votes in the election of directors. In an uncontested election, our Corporate Governance Guidelines provide that any nominee for director who receivesadjourned until a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation following certificationquorum is obtained.

What vote is required to approve each of the stockholder vote. The Nominatingproposals, and Corporate Governance Committeehow will abstentions and broker non-votes affect the Board must then decide whether or not to accept the tendered resignation, culminating with a public disclosure explaining the Board’s decision and decision-making process.outcome?

RecommendationApproval of the Board

We believe eachEquity Rights Proposal requires the affirmative vote of our eight director nominees have the professional and leadership experience, industry knowledge, commitment, diversity of skills and ability to work in a collaborative manner necessary to execute our strategic plans. We believe the election of the Company’s eight nominees named in Proposal No. 1 and on the proxy card best positions the Company to deliver value to and represent the interests of all Company stockholders.

The Board unanimously recommends a vote “FOR” its eight nominees for election as Director. Proxies solicited by the Board will be voted “FOR” Superior’s eight nominees unless stockholders specify a contrary vote.

BOARD STRUCTURE AND COMMITTEE COMPOSITION

Board Structure and Leadership

The Board has separated the roles of Chairperson of the Board and Chief Executive Officer, with Margaret Dano serving as Chairperson since April 1, 2014. The Board will elect a new Chairperson following Ms. Dano’s retirement from the Board effective immediately following the Annual Meeting; however, the Board intends to continue to separate the roles of Chairperson of the Board and Chief Executive Officer. The Board believes that this leadership structure best serves the objectives of the Board’s oversight of management, the Board’s ability to carry out its roles and responsibilities on behalf of stockholders and Superior’s overall corporate governance. The Board also believes that this leadership structure allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and will provide an appropriate balance between strong leadership, appropriate safeguards and oversight bynon-employee directors.

Superior’s Corporate Governance Guidelines provide the Board with flexibility to select the appropriate leadership structure depending on then current circumstances. In making leadership structure determinations, the Board considers many factors, including the specific needs of the business and what is in the best interests of Superior’s stockholders. If the Board appoints a Chairperson that is an independent director, pursuant to the terms of Superior’s Corporate Governance Guidelines, the Chairperson also serves as the “Lead Director.” If the Chairperson is not an independent director, on an annual basis, one of the independent directors is designated by a majority of the independent directorsvotes which all stockholders present in person or by proxy at the Special Meeting are entitled to becast on the Lead Director.proposal, assuming a

On an annual basis,3

quorum is present. The Company’s common stock and Series A Preferred Stock vote together as a single class on any matter on which the Board, with the assistanceholders of common stock are entitled to vote, however TPG, as holder of the NominatingCompany’s Series A Preferred Stock, is not entitled to vote on the Equity Rights Proposal. Under applicable NYSE Rules, abstentions are counted as present for purposes of determining a quorum and Corporate Governance Committee, makes an annual determinationare also counted as shares voted with respect to such proposal, and therefore, if you return your proxy card and “ABSTAIN” from voting, it will have the independencesame effect as a vote against the Equity Rights Proposal. A broker non-vote would have no effect on the outcome of each director using the current standards for “independence” established byproposal.

Approval of the New York Stock Exchange, additional criteria set forth in Superior’s Corporate Governance Guidelines and considerationAdjournment Proposal requires the affirmative vote of any other material relationship a director may have with Superior as disclosed in annual director and officer questionnaires. Our Corporate Governance Guidelines provide that a majority of the Board and all membersshares of common stock represented in person or by proxy at the Special Meeting, whether or not a quorum is present. Accordingly, an abstention will have the effect of a vote against the proposal, but a broker non-vote would have no effect on the outcome of the Audit, Compensationproposal.

What should I do if I receive more than one proxy card or other set of proxy materials for the Company?

If you hold your shares in multiple accounts or registrations, or in both registered and Benefitsstreet name, you will receive a proxy card for each account. Please sign, date and Nominatingreturn all proxy cards you receive from the Company. If you choose to vote by phone or by Internet, please vote once for each proxy card you receive. Only your latest dated proxy for each account will be voted.

I share an address with another stockholder, and Corporate Governance Committeeswe received only one paper copy of the Board will be independent.

The Board has determined that all of its current directors are independent under these standards, except for Donald J. Stebbins, our Chief Executive Officer. All members of each of Superior’s Audit, Compensation and Benefits and Nominating and Corporate Governance Committees are independent directors. In addition, upon recommendationproxy materials. How may I obtain an additional copy of the Nominating and Corporate Governance Committee, the Boardproxy materials?

Superior has determined that the members of the Audit Committee and Compensation and Benefits Committee meet the additional independence criteria required for audit committee and compensation committee membership under the New York Stock Exchange applicable listing standards.

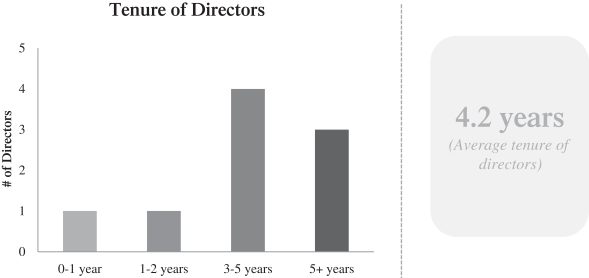

We recognize the importance of board refreshment to achieve the right blend of institutional knowledge and fresh perspectives. The composition of our Board has changed significantly in recent years. Six of our current directors joined the Board since 2013, with the size of the Board being increased to nine directors in 2016 with the appointment of Ms. Richstone. In addition, the Board has affirmatively determined that eight of our nine current directors are independent using the current standards for “independence” establishedadopted a procedure approved by the New York Stock Exchange.

Independent directors comprise 88.9%Securities and Exchange Commission (the “SEC”) called “householding.” Under this procedure, Superior delivers one set of our Board and the average tenure of our directors is 4.2 years:

Tenure by Director

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

During 2016, the Board held 6 meetings. During this period, all of the incumbent directors attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all Committees of the Board on which each such director served, during the period for which each such director served. All of Superior’s directors attended last year’s Annual Meeting on April 26, 2016, with the exception of Ms. Richstone,proxy materials to multiple stockholders who was not appointed to the Board until October 2016. Superior’s directors are not required, but are strongly encouraged, to attend the Annual Meeting of stockholders.

The Board and its Committees also consulted informally with management from time to time and acted at various times by written consent without a meeting during 2016. Additionally, the independent directors met in executive session regularly without the presence of management. The Chairperson and Lead Director, Ms. Dano, presided over executive sessions of the independent directors in 2016.

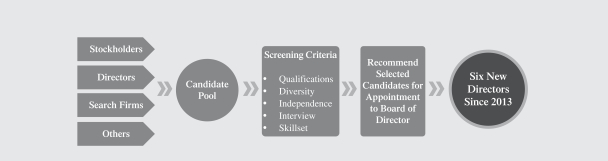

Our Nominating and Corporate Governance Committee seeks to build and maintain an effective, well-rounded, financially literate and diverse Board that represents all of our stockholders.

Process for Identification and Review of Directors Candidates to Join the Board

Identifying and recommending individuals for nomination, election orre-election to our Board is a principal responsibility of our Nominating and Corporate Governance Committee. This Committee carries out this function through an ongoing, year-round process, which includes the annual Board and committee evaluation process. Each director and director candidate is evaluated by the Nominating and Corporate Governance Committee based on his or her individual merits, taking into account Superior’s needs and the composition of our Board.

To assist in its evaluation of directors and director candidates, the Nominating and Corporate Governance Committee looks for certain experiences, qualifications, attributes and skills that would be beneficial to have represented on the Board and on our committees at any particular point in time. Nominees for the Board should be committed to enhancing long-term stockholder value and must possess relevant experience and skills, good business judgment and personal and professional integrity. Among the experiences, qualifications, attributes and skills considered by the Nominating and Corporate Governance Committee are senior executive experience, automotive industry experience, financial experience, public company board experience, operational management, international business, capital markets and/or banking experience, legal and regulatory compliance and diversity. The Nominating and Corporate Governance Committee seeks diversity of business experience, viewpoints and personal background, and diversity of skills in finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board.

In recommending candidates for election to the Board, the Nominating and Corporate Governance Committee considers nominees recommended by directors, officers, employees, stockholders and others, usingshare the same criteria to evaluate all candidates. The Nominating and Corporate Governance Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board. The Nominating and Corporate Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Any stockholder entitled to vote in the election of directors generally may nominateaddress unless Superior has received contrary instructions from one or more personsof the stockholders. This procedure potentially means extra convenience for electionstockholders and reduces Superior’s printing and mailing costs as directorwell as the environmental impact of its stockholder meetings. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, Superior will deliver promptly a separate copy of the proxy statement and annual report to any stockholder at a meeting by providing written notice of such stockholder’s intentshared address to make such nomination or nominations to the Corporate Secretarywhich Superior delivered a single copy of the Company not later thanproxy materials. If you are a stockholder who shares an address with another stockholder and would like only one copy of future notices and proxy materials for your household, you may notify your broker if your shares are held in a brokerage account or notify us if you are the closestockholder of business on the 90th day nor earlier than the closerecords.

To receive free of business on the 120th day prior to theone-year anniversarycharge a separate copy of the date of the preceding year’s annual meeting. With respect to an election to be heldproxy materials, stockholders may contact Superior’s Secretary at a special meeting of stockholders for the election of directors, stockholder nominations must be made not later than the close of business on the

later of the 90th day prior to such special meeting nor earlier than the close of business on the 120th day prior to such special meeting, or no later than the close of business on the 10th day following the date a public announcement has been made of the date of the special meeting and of the nominees proposed by the Board to be elected or reelected at such meeting. When submitting candidates for nomination to be elected at Superior’s annual meeting of stockholders, the stockholder must follow the notice procedures and provide the information required by the Bylaws. The notice must be submitted in writing to the following address: Superior Industries International, Inc., Attn: Corporate Secretary, 26600 Telegraph Rd., Suite 400, Southfield, MI 48033. The recommendation must include the same48033 or 248-352-7300.

Stockholders who hold shares in “street name” (as described below) may contact their brokerage firm, bank, broker-dealer or other similar organization to request information as is specified in the Bylaws for stockholder nominees to be considered at an Annual Meeting, including but not limited to the following:about householding.

The chairperson of the meeting may refuse to acknowledge the nomination of any person not made in compliance with these procedures, and the nomination shall be void.materials?

Proxy Access Bylaw.

In October 2016, we adopted a proxy access provision in our Bylaws. It allows a stockholder, or group of no more than 20 eligible stockholders, that has maintained continuous ownership of 3% or more of our common stock for at least three years to include in ourSuperior’s proxy materials for an annual meeting of stockholders a number of director nominees for up to 20% of the directors then in office as of the last day on which a notice of proxy access nomination may be delivered to the Company (if such an amount is not a whole number, then the closest whole number below 20%). An eligible stockholder must maintain the 3% ownership requirementalso are available at least until the annual meeting at which the proponent’s nominee will be considered. Proxy access nominees who withdraw, become ineligible or unavailable or who do not receive at least a 25% vote in favor of election will be ineligible as a nominee for the following two years. If any stockholder proposes a director nominee under our advance notice provision, we are not required to include any proxy access nominee in our proxy statement for the annual meeting.

The proponent is required to provide the information about itself and the proposed nominee(s) that is specified in the proxy access provision of our Bylaws. The required information must be in writing and provided to the Secretary of the Company not less than 90 days nor more than 120 days prior to the anniversary of the date

that the Company first distributed its proxy statement to stockholders for the immediately preceding annual meeting of stockholders. We are not required to include any proxy access nominee in our proxy statement if the nomination does not comply with the proxy access requirements of our Bylaws.

Any stockholder considering utilizing proxy access should refer to the specific requirements set forth in our Bylaws.

Superior has three standing committees: the Audit Committee, the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee. Each of these Committees has a written charter approved by the Board. A copy of each charter can be found by clicking on “Board Committee Charters” in the “Investors” section of our website at www.supind.com.www.supind.com/investor.html. This website address is included for reference only. The information contained on the Company’sthis website is not incorporated by reference into this Proxy Statement.proxy statement.

AUDIT COMMITTEEHow many votes do I have?

Each holder of record of Superior common stock and Series A Preferred Stock will be entitled to one vote on each matter for each share of common stock held, or into which its Series A Preferred Stock is convertible, on the Record Date.

4

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with Superior’s transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you by Superior.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the proxy materials were forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee or nominee how to vote your shares.

If I am a stockholder of record of Superior’s shares, how do I vote?

If you are a stockholder of record, there are four ways to vote:

| • | ||

|

|

| ||

|

| |

|

|

|

The Compensation and Benefits Committee’s responsibilities and duties include an annual review and approval of Superior’s compensation strategy to ensure that it promotes stockholder interests and supports Superior’s strategic and tactical objectives, and that it provides appropriate rewards and incentives for management and employees, including administration of Superior’s Amended and Restated 2008 Equity Incentive Plan and review of compensation-related risk management. For 2016, the Compensation and Benefits Committee performed these oversight responsibilities and duties by, among other things, directing a review of our compensation practices and policies generally, including conducting an evaluation of the design of our executive compensation program, in light of our risk management policies and programs. Additional information regarding the Compensation and Benefits Committee’s risk management review appears in the “Compensation Philosophy and Objectives” portion of the “Compensation Discussion and Analysis” section of this Proxy Statement.

On an annual basis, the Compensation and Benefits Committee reviews and makes recommendations to the Board regarding the compensation ofnon-employee directors,non-employee chairpersons, lead directors and Board committee members. In 2015, the Compensation and Benefits Committee engaged Willis Towers Watson to compile compensation surveys for review by the Compensation and Benefits Committee and to compare compensation paid to Superior’s directors with compensation paid to directors at companies included in the surveys. Additionally, the Compensation and Benefits

| • |

|

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, there are two ways to vote:

For additional description

| • | In person. If you are a beneficial owner of shares held in street name and wish to vote in person at the |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Superior is committed to having sound corporate governance principles. Key information regarding Superior’s corporate governance initiatives can be found on its website, including Superior’s Corporate Governance Guidelines, Superior’s Code of Conduct and the charter for each CommitteeYou must bring a copy of the Board. The corporate governance pages canlegal proxy to the Special Meeting and ask for a ballot from an usher when you arrive. You must also bring valid picture identification such as a driver’s license or passport and proof that the organization that holds your shares held such shares on the Record Date. In order for your vote to be found by clicking on “Corporate Governance” incounted, you must hand both the Investor sectioncopy of the website at www.supind.com. This website address is included for reference only. The information contained onlegal proxy and your completed ballot to an usher to be provided to the Company’s websiteinspector of election.

| • | By Proxy. If you are a beneficial owner of shares held in street name, this proxy statement and accompanying materials have been forwarded to you by the organization that holds your shares. Such organization will vote your shares in accordance with your instructions using the methods set forth in the information provided to you by such organization.See “What is a broker non-vote?” below. |

What happens if I do not incorporated by reference into this Proxy Statement.give specific voting instructions?

Corporate Governance Principles

Superior is committed to excellence in corporate governanceStockholders of Record. If you are a stockholder of record and maintains clear policies and practices that promote good corporate governance, including:you:

5

then the persons named as proxy holders will vote your shares in the manner recommended by the Board be independent (with 8 outon all matters presented in this proxy statement and, in accordance with applicable law, as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

Beneficial Owners of 9 current directors being independent).

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the taking of management.

Annual Board and Committee Self-Assessments

Each year, the directors undertake a self-assessment of the Board and each Committee on which they serve that elicits feedback on the performance and effectiveness of the Board and its Committees. As part of this self-assessment, the directors are asked to consider the Board’s role, relations with management, composition and meetings. Each Committee is asked to consider its role and the responsibilities articulated in the Committee charter, the composition of the Committee and the Committee meetings. Each Committee and the full Board reviews such self-assessments and considers areas that can benefit from change. These opportunities, as well as proposed action plans, are shared with the full Board and, if supported, the plan is implemented andre-assessed at the time of the next annual self-assessment.

Our Board, in coordination with the Compensation and Benefits Committee, oversees and is actively engaged in Chief Executive Officer and senior management succession planning, which is reviewed at least annually. As part of its succession planning process, the Board reviews the senior management team’s experience, skills, competence and potential, in order to assess which executives have the ability to develop the attributes that the Board believes are necessary to lead and achieve the Company’s goals. Directors personally assess candidates by engaging with potential successors at Board and Committee meetings, as well as less formal settings.

The Role of the Board in Risk Oversight

Superior’s management is responsible forday-to-day risk management activities. The Board, acting directly and through its Committees, is responsible for the oversight of Superior’s risk management. Superior and the Board approach risk management by integrating and communicating strategic planning, operational decision-making and risk oversight. The Board commits extensive time and effort every year to discussing and agreeing upon Superior’s strategic plan, and it reconsiders key elements of the strategic plan as significant events and opportunities arise during the year. As part of the review of the strategic plan, as well as in evaluating events and opportunities that occur during the year, the Board and management focus on the primary success factors and risks for Superior. With such oversight of the Board, Superior has implemented practices and programs designed to help manage the risks to which Superior is exposed in its business and to align risk-taking appropriately with its efforts to increase stockholder value. Superior’s internal audit department provides both management and the Audit Committee, which oversees our financial and risk management policies, with ongoing assessments of Superior’s risk management processes and system of internal control and the specific risks facing Superior.

While the Board has primary responsibility for oversight of the Company’s risk management, the Board’s standing Committees support the Board by regularly addressing various risks in their respective area of oversight. Specifically, the Audit Committee identifies and requires reporting on areas perceived as potential risks to Superior’s business. As provided in its Committee charter, the Audit Committee reports regularly to the Board. As part of the overall risk oversight framework, other Committees of the Board also oversee certain categories of risk associated with their respective areas of responsibility. For example, the Compensation and Benefits Committee oversees compensation-related risk management, as discussed further under “Compensation and Benefits Committee” and in the “Compensation Philosophy and Objectives” portion of the “Compensation Discussion and Analysis” section of this proxy.

Each Committee reports regularly to the full Board on its activities. In addition, the Board participates in regular discussions among the Board and with Superior’s senior management of many core subjects, including strategy, operations, finance and legal and public policy matters, in which risk oversight is an inherent element. The Board believes that the leadership structure described above under “Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, with leadership from the independent Lead Director and working through its Committees, including the independent Audit Committee, to participate actively in the oversight of management’s actions.

Stockholder Communications with the Board

Stockholders may communicate with Superior’s Board, or any individual member or members of the Board, through Superior’s Secretary at Superior Industries International, Inc., 26600 Telegraph Rd., Suite 400, Southfield, MI 48033 with a request to forward the communicationprior to the intended recipientSpecial Meeting.

Who will serve as the inspector of election?

A representative from Broadridge will serve as the inspector of election.

How can I attend the Special Meeting?

Only stockholders as of the Record Date are entitled to attend the Special Meeting. Each stockholder must present valid picture identification such as a driver’s license or recipients. In general, any stockholder communication delivered to Superior for forwarding topassport and provide proof of stock ownership as of the BoardRecord Date. The use of mobile phones, pagers, recording or specified director photographic equipment, tablets and/or directorscomputers is not permitted at the Special Meeting.

Where can I find the voting results?

Preliminary voting results will be forwardedannounced at the Special Meeting. Final voting results will be tallied by the inspector of election after the taking of the vote at the Special Meeting. Superior will publish the final voting results in accordancea Current Report on Form 8-K, which Superior is required to file with the stockholder’s instructions. However,SEC within four business days following the Company reservesSpecial Meeting.

Who is paying the right not to forward to directors any abusive, threatening or otherwise inappropriate materials.

Corporate Governance Guidelines

The Board believes in sound corporate governance practices and has adopted formal Corporate Governance Guidelines to enhance its effectiveness. Our Board has adopted these Corporate Governance Guidelines in order to ensure that it has the necessary authority and practices in place to fulfill its rolecosts of management oversight and monitoring for the benefit of our stockholders. The Corporate Governance Guidelines set forth the practices our Board will follow with respect to, among other areas, director qualification and independence, board and Committee meetings, involvement of and access to management, and Chief Executive Officer Performance evaluation and succession planning. The Corporate Governance Guidelines are publicly available on our website, www.supind.com, under “Investors.” This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement.

Our Code of Conduct is included on our website, www.supind.com, under “Investors,” which, among others, applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement. Upon request to Superior Industries International, Inc., Investor Relations, 26600 Telegraph Rd., Suite 400, Southfield, MI 48033, copies of our Code of Conduct are available, without charge.

Superior uses a combinationis paying the costs of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on the Board.solicitation of proxies. Superior does not provide any perquisites to itsnon-employee Board members. In setting the compensation ofnon-employee directors, Superior considers the significant amount of time that the Board members expend in fulfilling their duties to Superior as well as the experience level required to serve on the Board. The Board, through its Compensation and Benefits Committee, annually reviews the compensation arrangements and compensation policies fornon-employee directors,non-employee chairpersons, lead directors and Board Committee members. The Compensation and Benefits Committee recently reviewed market data compiled by Willis Towers Watsonhas retained Okapi Partners LLC to assist in assessing totalnon-employee director compensation. Pursuantobtaining proxies by mail, facsimile, telephone or email from brokerage firms, banks, broker-dealers or other similar organizations representing beneficial owners of shares for the Special Meeting. We have agreed to our Corporate Governance Guidelines, in recommending director compensation, our Compensation and Benefits Committee is guided by three goals: (i) compensation should fairly pay directorssuch firm a fee of approximately $50,000.00 plus out-of-pocket expenses. Okapi Partners LLC may be contacted toll-free at (877) 629-6356. Superior may also reimburse brokerage firms, banks, broker-dealers or other similar

6

organizations for work required in a companythe cost of forwarding proxy materials to beneficial owners. In addition, certain of Superior’s sizedirectors, officers and scope; (ii)regular employees, without additional compensation, should align directors’ interests withmay solicit proxies on Superior’s behalf in person, by telephone, by fax or by electronic mail. See “Proxy Solicitation and Costs” in this proxy statement for further information.

What happens if the long-term interestsSpecial Meeting is postponed or adjourned?

If the Special Meeting is postponed or adjourned due to a lack of Superior’s stockholdersa quorum or to solicit additional proxies, we intend to reconvene the Special Meeting as soon as reasonably practical. Your proxy will still be effective and (iii)may be voted at the structure ofrescheduled or adjourned meeting, and you will still be able to change or revoke your proxy until it is voted at the compensation should be clearly disclosed to Superior’s stockholders.rescheduled or adjourned meeting.

Ournon-employee director cash compensation program during 2016 consisted of the following:

Non-employee directors typically do not receive forms of remuneration, perquisites or benefits, but are reimbursed for their expenses in attending meetings. There are no cash fees payable for attendance at Board or Committee meetings.7

Under Superior’s Amended and Restated 2008 Equity Incentive Plan, members of the Board who were not also Superior employees (other than Ellen B. Richstone who joined the Board in October 2016) were granted 2,946 RSUs on April 26, 2016. These RSUs vest in full on the first anniversary of the grant date.

The following table provides information as to compensation for services of thenon-employee directors during 2016.

Director Compensation Table

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards(2) ($) | Pension Value and Nonqualified Deferred Compensation Earnings(3) ($) | Total ($) | ||||||||||||

Michael R. Bruynesteyn | $ | 66,065 | $ | 74,976 | — | $ | 141,041 | |||||||||

Margaret S. Dano(4) | $ | 150,000 | $ | 74,976 | $ | 110,335 | $ | 335,311 | ||||||||

Jack A. Hockema | $ | 69,500 | $ | 74,976 | — | $ | 144,476 | |||||||||

Paul J. Humphries | $ | 70,000 | $ | 74,976 | — | $ | 144,976 | |||||||||

James S. McElya | $ | 66,000 | $ | 74,976 | — | $ | 140,976 | |||||||||

Timothy C. McQuay | $ | 73,000 | $ | 74,976 | — | $ | 147,976 | |||||||||

Ellen B. Richstone(5) | $ | 12,613 | — | — | $ | 12,613 | ||||||||||

Francisco S. Uranga | $ | 64,000 | $ | 74,976 | $ | 23,849 | $ | 162,825 | ||||||||

Non-Employee Director Stock Ownership

Effective July 2015, the Board adopted an amended and restated stock ownership policy for members of the Board. The policy requires eachnon-employee director to own shares of Superior’s common stock having a value equal to at least three times thenon-employee director’s regular annual cash retainer, with a three-year period to attain that ownership level. All of ournon-employee directors are in compliance with this stock ownership policy. Additionally, all of ournon-employee directors (other than Mr. Bruynesteyn, who joined the Board in November 2015 and Ms. Richstone, who joined the Board in October 2016) meet the required ownership level under this stock ownership policy.

PROPOSAL NO. 21 – ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATIONEQUITY RIGHTS PROPOSAL

Superior provides its stockholdersApproval of the Conversion Right and the Preemptive Right

Background of the Investment

Pursuant to the Investment Agreement, which we signed on March 22, 2017, TPG agreed to make a $150 million equity investment in the Company in exchange for shares of our newly created Series A Preferred Stock and shares of our newly created Series B Preferred Stock, the terms of each of which are outlined in our Certificate of Designations relating to the Series A Preferred Stock and Series B Preferred Stock filed with our Certificate of Incorporation, and described under “Description of the Preferred Stock” below. In addition, we agreed to the terms of an Investor Rights Agreement, which was entered into upon closing of the Investment on May 22, 2017. TPG’s ownership in the Company was approximately 19.99% on an as-converted basis at the closing of the Investment on May 22, 2017. For a more detailed description of TPG Growth’s equity investment in the Company and each of the Investment Documents, see “Description of the Investment Documents” below.

We were attracted to the opportunity with TPG because (i) it provided a large single source of capital to castfinance a portion of the Uniwheels transaction, (ii) provided capital that was less restrictive than debt, (iii) the conversion issue price negotiated was at a 15% premium to our 30-day trailing average common stock price, and (iv) we believe that the strategic relationship with TPG will provide significant benefits to us as a result of TPG’s broad business relationships, including in our industry. Additionally, we believe that TPG, through its representation on our Board, will provide valuable insight to the Company as it continues to execute its growth strategy, including through the acquisition of Uniwheels.

Equity Rights Proposal Highlights

The Company’s common stock is listed on the NYSE and, as a result, the Company is subject to certain NYSE listing rules and regulations. NYSE Rule 312.03(c) requires stockholder approval prior to the issuance of common stock, or securities convertible into or exercisable for common stock, in any transaction or series of transactions if (i) the common stock to be issued has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock, or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock. Because of this restriction, in exchange for the Investor’s $150 million investment in the Company, the Investor received 140,202 shares of Series A Preferred Stock, which was convertible into a number of shares of common stock representing approximately 19.99% of our outstanding common stock prior to such issuance and, in lieu of additional shares of Series A Preferred Stock, the Investor received 9,798 shares of Series B Preferred Stock. Pursuant to the terms of the Company’s Certificate of Designations, all outstanding Series B Preferred Stock will convert into shares of our Series A Preferred Stock (and, consequently, become convertible into shares of our common stock) only upon receipt of stockholder approval.

If the Company’s stockholders do not approve the Equity Rights Proposal, then the Series B Preferred Stock will not convert into Series A Preferred Stock and, therefore, not become convertible into common stock. Furthermore, if stockholder approval is not obtained by September 19, 2017, the dividend rate applicable to the Series B Preferred Stock will increase from 9% per annum to 11% per annum unless and until stockholder approval is subsequently obtained. Dividends on either the Series A Preferred Stock the Series B Preferred Stock are payable, at the Company’s election, in cash or in the form of an annual advisory vote on executive compensation (a“Say-on-Pay” proposal). At Superior’s 2016increase in the Stated Value of such share. Until stockholder approval is obtained, any non-cash dividends must be paid in the form of an increase in the Stated Value of the Series B Preferred Stock and shall not result in an increase in the Stated Value of the Series A Preferred Stock.

The NYSE has certain additional rules, including NYSE Rule 312.03(b), which requires stockholder approval prior to issuances of securities to, among others, directors and substantial stockholders of the Company,

8

that could be implicated in the future if the Investor exercises the Preemptive Right. In order to eliminate any requirement that the future exercise of the Preemptive Right would require stockholder approval, we are seeking such approval now as part of the Equity Rights Proposal. For a more detailed description of the Preemptive Right, see the description under “Description of the Investment Documents—Investor Rights Agreement—Preemptive Rights” below.

Finally, if the stockholders do not approve the Equity Rights Proposal at the Special Meeting, then the Company is obligated to use its reasonable best efforts to obtain stockholder approval at the Company’s next annual meeting of stockholders approximately 67%and each subsequent annual meeting thereafter.

Based on the capitalization of the votes cast on theSay-on-Pay proposal were voted in favorCompany as of the compensationRecord Date, the conversion of Superior’s named executive officers (“NEOs”).

As detailedall of the Series A Preferred Stock into shares of common stock (including shares of Series A Preferred Stock issuable upon conversion of the Series B Preferred Stock) would result in the “Compensation Discussion and Analysis” beginning on page 36, members of the Compensation and Benefits Committee engaged with stockholders during 2016 (both before and after the 2016 annual meeting) to obtain input regarding the executive compensation policies and practices as did Superior’s management team during the course of its general stockholder outreach in 2016. Several modifications to Superior’s program were made as a result of input received from this stockholder engagement effort:

Executive Compensation Program Changes in 2016 and 2017

Our executive compensation program also continues to follow several other best practices that are discussed beginning on page 36 in the “Compensation Discussion and Analysis,” some of which are summarized as follows:

Executive Compensation Program Best Practices

The Compensation and Benefits Committee intends to continue its stockholder outreach efforts in 2017 regarding Superior’s executive compensation programs. The Compensation and Benefits Committee will continue to consider the results of futureSay-on-Pay votes when making future compensation decisions for Superior’s named executive officers.

As shown above, the core of Superior’s executive compensation philosophy and practice continues to be an emphasis on pay for performance – withInvestor owning approximately 2/3 of annual equity grants being subject to attainment of performance goals. Superior’s executive officers are compensated in a manner consistent with Superior’s strategy, competitive practice, sound corporate governance principles, and stockholder interests and concerns. We believe our compensation program is strongly aligned with the long-term interests% of our stockholders. We urge yououtstanding common stock after giving effect to read the “Compensation Discussion and Analysis,” the compensation tables and the narrative discussion set forth on pages 36 to 61 of this Proxy Statement for additional details on Superior’s executive compensation program.

We are asking stockholders to vote on the following resolution:

RESOLVED, that the stockholders approve the compensation of Superior’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the “Compensation Discussion and Analysis,” the compensation tables and narrative discussion.

Vote Required

Approval of this proposal requires (i) a majority of the shares represented and voting at the Annual Meeting at which a quorum is present and (ii) that shares voting affirmatively also constitute at least a majority of the required quorum. If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal.

Recommendation of the Board of Directorssuch conversion.

The Board unanimously recommends a voteTHE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” the approval of thenon-binding advisory resolution to approve executive compensation.THE EQUITY RIGHTS PROPOSAL.

9

PROPOSAL NO. 3 – ADVISORY VOTE ON THE FREQUENCYDESCRIPTION OF THE ADVISORY VOTE ON EXECUTIVE COMPENSATIONINVESTMENT DOCUMENTS

As required by the Dodd-Frank Act and Section 14A of the Exchange Act, we are providing stockholders an advisory vote on the frequency with which the stockholders shall have the opportunity to cast a vote on the advisory“say-on-pay” vote on executive compensation of the nature reflected in Proposal 2 above. The advisory vote on the frequency of thesay-on-pay vote is anon-binding vote as to how often thesay-on-pay vote should occur: every year, every two years or every three years. In addition, stockholders may abstain from voting. At the 2011 annual meeting, our stockholders previously supported a one year frequency for this stockholder advisory vote.